Quiz

5 option trading strategies for beginners

5 options trading strategies for beginners

JAMES ROYAL, bankrate.comOptions are among the most popular vehicles for traders, because their price can move fast, making (or losing) a lot of money quickly. Options strategies can range from quite simple to very complex, with a variety of payoffs and sometimes odd names.

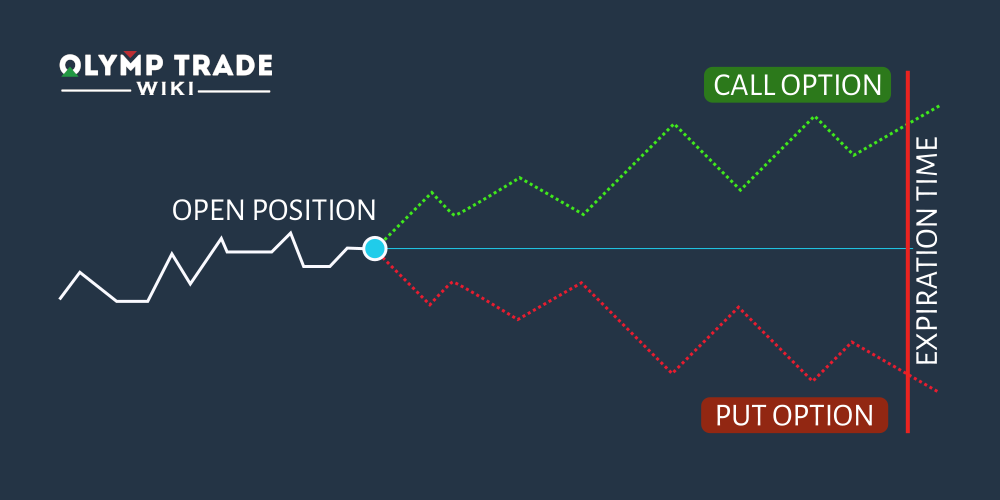

Regardless of their complexity, all options strategies are based on the two basic types of options: the call and the put. Below are five popular strategies, a breakdown of their reward and risk and when a trader might use them. While these strategies are fairly straightforward, they can make a trader a lot of money — but they aren’t risk-free.

1. Long call

In this strategy, the trader buys a call – referred to as “going long” a call – and expects the stock price to exceed the strike price by expiration. The upside on this trade is uncapped, if the stock soars, and traders can earn many times their initial investment.

The upside on a long call is theoretically infinite. If the stock continues to rise before expiration, the call can keep climbing higher, too. For this reason long calls are one of the most popular ways to wager on a rising stock price.

The downside on a long call is a total loss of your investment. If the stock finishes below the strike price, the call will expire worthless and you’ll be left with nothing.

2. Covered callA covered call involves selling a call option (“going short”) but with a twist. Here the trader sells a call but also buys the stock underlying the option, 100 shares for each call sold. Owning the stock turns a potentially risky trade – the short call – into a relatively safe trade that can generate income. Traders expect the stock price to be below the strike price at expiration. If the stock finishes above the strike price, the owner must sell the stock to the call buyer at the strike.

The upside on the covered call is limited to the premium received, regardless of how high the stock price rises. You can’t make any more than that, but you can lose a lot more. Any gain that you otherwise would have made with the stock rise is completely offset by the short call.

The downside is a complete loss of the investment, assuming the stock goes to zero, offset by the premium received. The covered call leaves you open to a significant loss, if the stock falls.

In this strategy, the trader buys a put – referred to as “going long” a put – and expects the stock price to be below the strike price by expiration. The upside on this trade can be many multiples of the initial investment, if the stock falls to zero.

The upside on a long put is almost as good as on a long call, because the option premium can increase many times in value. However, a stock can never go below zero, capping the upside, whereas the long call has theoretically unlimited upside. Long puts are another simple and popular way to wager on the decline of a stock, and they can be safer than shorting a stock.

The downside on a long put is capped at the premium paid, $100 here. If the stock finishes above the strike price, the put expires worthless and you’ll be left with nothing.

4. Short putThis strategy is the flipside of the long put, but here the trader sells a put – referred to as “going short” a put – and expects the stock price to be above the strike price by expiration. In exchange for selling a put, the trader receives a cash premium, which is the best upside a short put can earn. If the stock finishes below the strike price, the trader must buy it at the strike price.

The upside on the short put is never more than the premium received, $100 here. Like the short call or covered call, the maximum return on a short put is what the seller receives upfront.

The downside of a short put is the total value of the underlying stock minus the premium received, and that would happen if the stock went to zero. In this example, the trader would have to buy $2,000 of the stock (100 shares * $20 strike price), but this would be offset by the $100 premium received, for a total loss of $1,900.

5. Married putThis strategy is like the long put with a twist. The trader owns the underlying stock and also buys a put. This is a hedged trade, in which the trader expects the stock to rise but wants “insurance” in the event that the stock falls. If the stock does fall, the long put offsets the decline.

The maximum upside of the married put is theoretically uncapped, as long as the stock continues rising, minus the cost of the put. The married put is a hedged position, and so the premium is the cost of insuring the stock and giving it a chance to rise with limited downside.

The downside of the married put is the cost of the premium paid. As the value of the stock position falls, the put increases in value, covering the decline dollar for dollar. Because of this hedge, the trader only loses the cost of the option rather than the bigger stock loss.

Go To Source

Go To Source

DISCLAIMER

For information purposes only; not intended as financial advice