Quiz

Forces that move stock prices

Forces that move stock prices

DAVID R HARPER, investopedia.comStock prices are determined in the marketplace, where seller supply meets buyer demand. But have you ever wondered about what drives the stock market—that is, what factors affect a stock's price?

Unfortunately, there is no clean equation that tells us exactly how a stock price will behave. That said, we do know a few things about the forces that move a stock up or down. These forces fall into three categories: fundamental factors, technical factors, and market sentiment.

The key fundamental factors are:

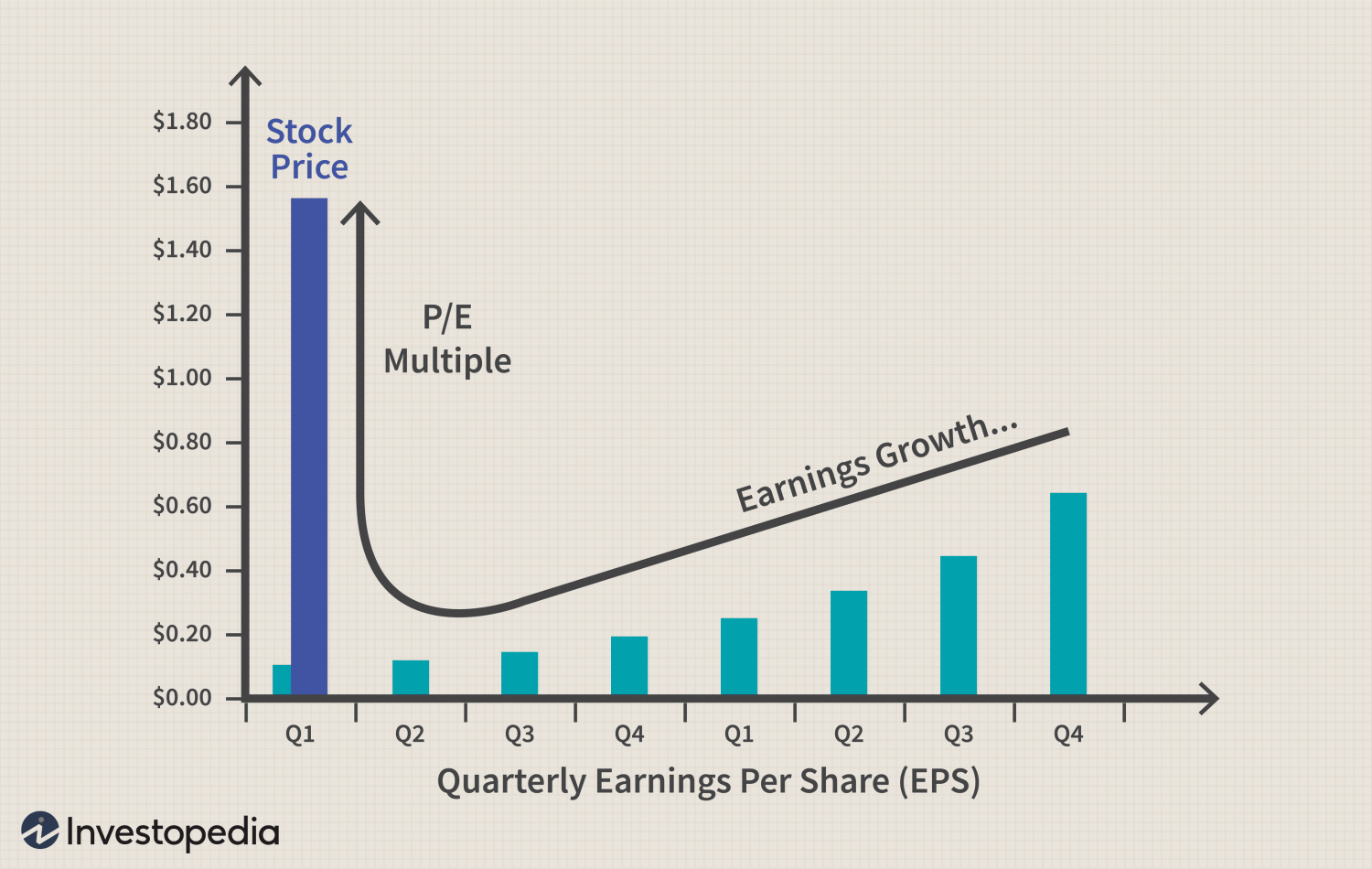

The level of the earnings base (represented by measures such as EPS, cash flow per share, dividends per share).

The expected growth in the earnings base.

The discount rate, which is itself a function of inflation.

The perceived risk of the stock.

Technical Factors

Things would be easier if only fundamental factors set stock prices. Technical factors are the mix of external conditions that alter the supply of and demand for a company's stock. Some of these indirectly affect fundamentals. For example, economic growth indirectly contributes to earnings growth. Technical factors include the following:

Inflation

Historically, low inflation has had a strong inverse correlation with valuations (low inflation drives high multiples and high inflation drives low multiples). Deflation, on the other hand, is generally bad for stocks because it signifies a loss in pricing power for companies.

Economic Strength of Market and Peers

Company stocks tend to track with the market and with their sector or industry peers. Some prominent investment firms argue that the combination of overall market and sector movements—as opposed to a company's individual performance—determines a majority of a stock's movement. (Research has suggested the economic/market factors account for 90 percent of it.) For example, a suddenly negative outlook for one retail stock often hurts other retail stocks as "guilt by association" drags down demand for the whole sector.

Substitutes

Companies compete for investment dollars with other asset classes on a global stage. These include corporate bonds, government bonds, commodities, real estate, and foreign equities. The relationship between demand for U.S. equities and their substitutes is hard to figure, but it plays an important role.

Incidental Transactions

Incidental transactions are purchases or sales of a stock that are motivated by something other than belief in the intrinsic value of the stock. These transactions include executive insider transactions, which are often pre-scheduled or driven by portfolio objectives. Another example is an institution buying or shorting a stock to hedge some other investment. Although these transactions may not represent official "votes cast" for or against the stock, they do impact supply and demand and, therefore, can move the price.

Demographics

Some important research has been done about the demographics of investors. Much of it concerns these two dynamics:

Middle-aged investors, peak earners who tend to invest in the stock market

Older investors, who tend to pull out of the market in order to meet the demands of retirement

The hypothesis is that the greater the proportion of middle-aged investors among the investing population, the greater the demand for equities and the higher the valuation multiples.

Trends

Often a stock simply moves according to a short-term trend. On the one hand, a stock that is moving up can gather momentum, as "success breeds success" and popularity buoys the stock higher. On the other hand, a stock sometimes behaves the opposite way in a trend and does what is called reverting to the mean. Unfortunately, because trends cut both ways and are more obvious in hindsight, knowing that stocks are "trendy" does not help us predict the future.

Liquidity

Liquidity is an important and sometimes under-appreciated factor. It refers to how much interest from investors a specific stock attracts. Wal-Mart's stock, for example, is highly liquid and therefore highly responsive to material news; the average small-cap company is less so.3 Trading volume is not only a proxy for liquidity, but it is also a function of corporate communications (that is, the degree to which the company is getting attention from the investor community). Large-cap stocks have high liquidity—they are well followed and heavily transacted. Many small-cap stocks suffer from an almost permanent "liquidity discount" because they simply are not on investors' radar screens.

News

While it is hard to quantify the impact of news or unexpected developments inside a company, industry or the global economy, you can't argue that it does influence investor sentiment. The political situation, negotiations between countries or companies, product breakthroughs, mergers and acquisitions and other unforeseen events can impact stocks and the stock market. Since securities trading happens across the world and markets and economies are interconnected, news in one country can impact investors in another, almost instantly.

Market Sentiment

Market sentiment refers to the psychology of market participants, individually and collectively. This is perhaps the most vexing category. Market sentiment is often subjective, biased, and obstinate. For example, you can make a solid judgment about a stock's future growth prospects, and the future may even confirm your projections, but in the meantime, the market may myopically dwell on a single piece of news that keeps the stock artificially high or low. And you can sometimes wait a long time in the hope that other investors will notice the fundamentals.

Go To Source

Go To Source

DISCLAIMER

For information purposes only; not intended as financial advice