Quiz

How to short a stock

How to short a stock

SHANTHI REXALINE, benzinga.comProfiting from an upward trending market is straightforward and simple. However, to make some bucks from a declining market, traders adopt a strategy called shorting. Read on to learn the process of how to short a stock

What Does it Mean to Short a Stock?

By definition, shorting is the process of borrowing and selling a security that you don’t own in a falling market. This is done in anticipation of buying it at a later date for a lower price.

The profit you pocket is the difference between the money at which you sell the shorted security and the money you expend on buying back the security at a later date. In this case, the trader makes a profit when the price of a security falls instead of rises.

How Do You Short a Stock?

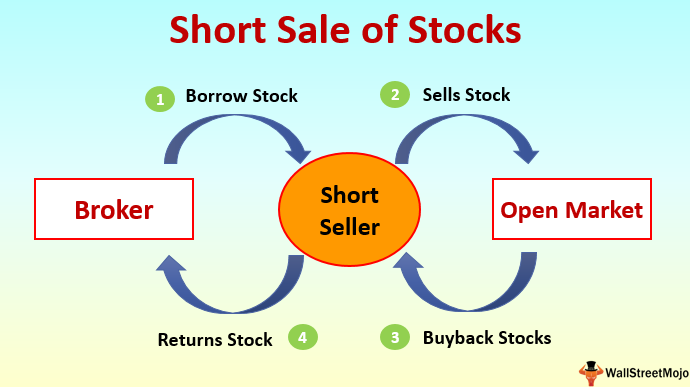

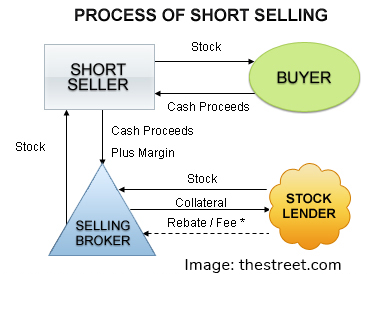

Despite the fact that it sounds complicated, the process of shorting is easy to understand and put into practice. The whole transaction can be explained in four simple steps:

A short seller borrows securities he intends to sell from his broker.

He sells the securities in the market at the current market price.

The short buys back the securities from the market at a lower price (if his bet goes right). He then returns the loaned securities.

What to Know Before Short Selling?

If you’re considering shorting a stock, make sure you’re informed about the prerequisites before you short.

-

- The security used for shorting should be liquid, otherwise, it would be difficult for the broker to borrow it on behalf of its client.

-

- An investor who intends to short a security should maintain a margin account with his broker, as margin is needed for shorting.

-

- Shorting is done with borrowed capital, so if a broker charges interest on the capital, the profit earned will be trimmed to that extent.

-

- Short selling is allowed only when the security is on an upswing or is trading flat.

Options for Shorting a Stock

Shorting could lead to staggering losses if the shorted stock continues to move higher. A safe alternative to shorting is a put option, which gives you the right, but not the obligation, to sell the underlying security at the strike price on or before the expiration of the option.

For example, if you buy one 50 strike put option at the money (underlying stock price is equal to the put strike price), you can sell 100 shares at $50 each. You stand to make a profit when the price of the stock drops below the $50, as you get to buy the stock below the strike price, and you can pocket the difference between the strike price and your purchase price. Alternatively, you can sell the put option contract and make a profit on your initial investment, which will fetch you better returns than what you gain on plain shorting.

Risks of Shorting a Stock

Before you begin shorting stocks, it’s important to understand all the risks associated with this type of trade.

One of the key risks associated with shorting is a short squeeze, which occurs when unexpected positive news concerning the company or the market triggers an upward move, sending shorts scurrying to cover their positions with minimal losses.

When more people chase the security to cover their short positions, demand perks up, triggering a further rise in the price of a security. There is also something called buy-ins, which means a broker is forced to close out a short position in a highly non-liquid stock, as the lender demands the security back.

Despite the very obvious pitfalls, shorting as a trading strategy is here to stay, primarily because of the opportunities to make money even in a downward-bound market.

Go To Source

Go To Source

DISCLAIMER

For information purposes only; not intended as financial advice